Inherited ira distribution calculator

Change the year to calculate a previous years RMD. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

In 2019 Congress changed the rules for required minimum distributions RMDs from inherited individual retirement account IRA and employer-sponsored account balance.

. You are under age 59½ and you intend to take a distribution from your IRA. Calculate the required minimum distribution from an inherited IRA. 36 rows aka Minimum Required Distribution Calculator This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from.

The year to calculate the Required Minimum Distribution RMD. Do Your Investments Align with Your Goals. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Beneficiarys name Please enter the. 1 to 31 Year.

Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Inherited IRA RMD Calculator - powered by SSC Inherited IRA Distribution Calculator Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy. For assistance please contact 800-435-4000.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. 1 to 12 Day. Open an Inherited IRA.

Determine beneficiarys age at year-end following year of owners. Yes Spouses date of birth Your Required Minimum. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments.

You can also explore your IRA beneficiary withdrawal options based. You will be subject to the 10 early withdrawal penalty in your IRA but would not be subject to this penalty from an. This calculator is undergoing maintenance for the new IRS tables.

Distribute using Table I. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Ad Use This Calculator to Determine Your Required Minimum Distribution.

10 year method Option 3. Open an Inherited IRA. If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs.

Starting the year you turn age 70-12. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. Ad Inherited an IRA.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from. Learn More About Inherited IRAs. Inherited IRA Distributions Calculator keyboard_arrow_down.

Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. If you are age 72 you may be subject to taking annual withdrawals known as. Schwab Can Help You Through The Process.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators.

Rather for IRA owner deaths that occur after December 31 2019 a designated beneficiary must deplete the account within 10 years unless the person is an eligible designated beneficiary. IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the. Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022.

1920 to 2022 What is your date of birth. You can make your first withdrawal by December 31 of the year you turn 70½ or 72 if born after June 30 1949 instead of waiting until April 1 of the following year which would. This calculator has been updated to reflect the new.

Life expectancy method Option 2. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. This is typically the current year.

Find a Dedicated Financial Advisor Now. Lump sum distribution Account holder over 72 If the account holder.

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Pin On Personal Finance

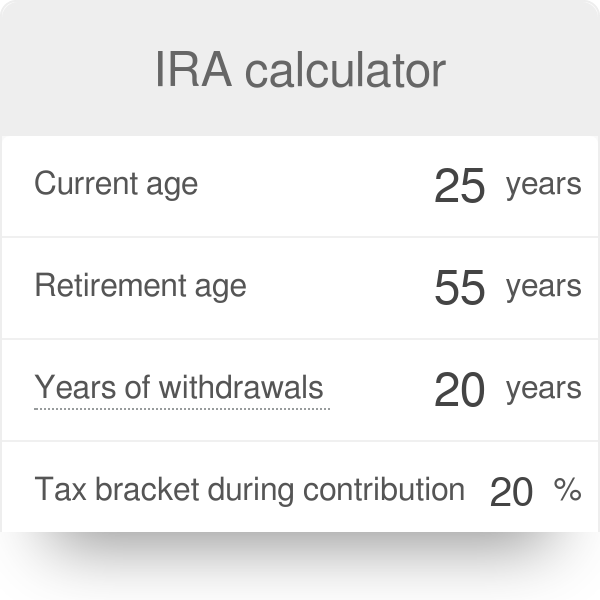

Ira Calculator

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Rmd Table Rules Requirements By Account Type

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

The Mega Roth An Interesting Twist For Super Savers Under The Proposed New Secure Act Tax Free Savings Retirement Money Savers

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Inherited Ira Rmd Calculator Td Ameritrade

Learn How To Calculate Online Advertising Rates To Make Money Blogging Inherited Ira Blog Advertising Money Blogging

Rmd Calculator Required Minimum Distributions Calculator

Ira Required Minimum Distribution Table Sound Retirement Planning

Pin By Pinna Birdie On Financial Affairs In 2022 Inherited Ira Ira Roth Ira Contributions

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More